On Friday, the US Secretary of the Treasury, Janet Yellen, warned the US must take “extraordinary measures” to avoid defaulting on its debt as soon as January 19. Yellen explained she would impose those extraordinary measures until Congress agreed to raise the debt ceiling – again. Welcome to the latest round of the debt limit crisis.

What Is the Debt Ceiling

The debt ceiling is an imaginary line imposed by Congress 106 years ago to restrict irresponsible spending. It limits the amount of money the government can borrow, placing a cap on government spending. That was the idea in 1917, anyway. Today it is the instrument that sets off perennial alarms among think tanks and the media. As the US consistently hits the debt limit more and more frequently, economists warn that failure to raise the debt ceiling will result in “financial Armageddon.”

- Additional Reading: The US May Finally Breach the Debt Ceiling. Here’s Why That Would Be Very Bad (New York Times)

There is some truth in this. The global economy is pegged to the US economy. The most reliable investment in the world is US debt. If the US defaults on its debts, that will set off a ripple of economic repercussions unlike anything experienced in the post-World War II era.

Still, the cries to raise the debt ceiling inspire a sense of bewilderment among those whose view of the world is rooted more in common sense than politics. If a diabetic person tests their blood sugar levels and learns they are approaching dangerous levels that border on hyperglycemia, the solution is not to adjust the levels of what is safe and appropriate and redefine the danger zone. The answer is to change the diet, lifestyle, and medications impacting their blood sugar.

That is the logic of a different age, though. As we approach the danger zone with the debt ceiling for the second time in less than two years, the solution (again) is to raise the debt ceiling rather than adjust the habitual inputs (spending), which leads to excessive debt.

History of the Debt Ceiling

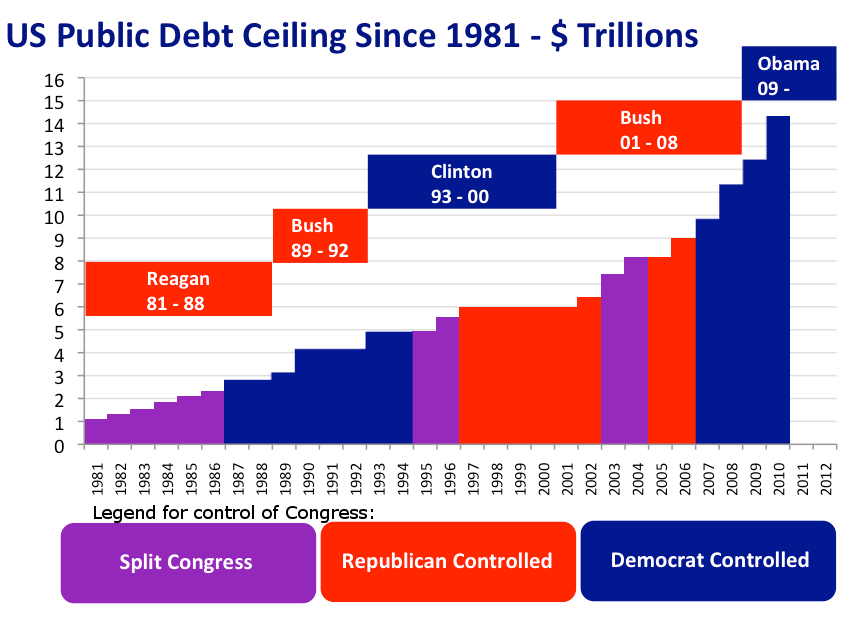

The debt ceiling was created in 1917. During the 20th century, it was raised around 90 times. Those increases began growing significantly during the 1960s thanks to new forms of government social safety net spending and the Vietnam War, but the growth of the 1960s paled compared to what began in the 1980s.

Students of American economic history may note that the as the debt limit has increased since the 1980s, there is a correlated effect on overall economic health. Economic inequality increased, along with economic crises and corruption scandals. Anyone who believes increasing the US debt limit creates a healthier economy in not looking at the facts. The debt ceiling has taken on the same characteristics of the finance industry in 2008, which we called “too big to fail” and thus requires frequent bailouts – until the bailouts stop working.

What Default Would Mean

The US has never defaulted on its debt. There have been close calls. During the War of 1812, many parts of the nation’s capital were burned, including the Treasury. In 2011, a delay in raising the debt ceiling resulted in the first downgrade of the country’s credit rating, which in turn sent markets roiling and an increase in borrowing costs.

The Council of Economic Advisors says default would mean Americans who rely on government assistance would not get it, including retirees and veterans. That would be the first wave of effects. The US would not have the funds to deploy the military. The National Weather Service would be unable to warn Americans of major weather events. Massive unemployment, recession, and decimation of retirement funds would follow. Many economists say the self-inflicted catastrophe would be worse than the 2008 economic meltdown. In December, the think tank Third Way issued a report warning about the domino effects of a debt limit default. Their report suggested job losses of more than 3 million, the national debt would grow by $850 billion, the average 30-year mortgage would increase by $130,000, and prices on everyday household items would soar across the country. In the event of a default, these consequences would pile on top of an already exhausted and inflated US economy.

These are short-term consequences. The long term would be a rearrangement of the world financial order. As global markets collapsed, other nations would push to the forefront, hoping to be the new global economic leader.

Toying With Chaos

The United States government is toying with the edge of economic chaos for the second time in two years. Rather than dealing with the root issues and resolving the excessive and irresponsible spending driving the persistent debt ceiling crises of recent decades, the best case scenario we can hope for is that our leaders will come to some agreement that involves once again kicking the can down the road.

This week, we will begin hearing high volumes of inflamed rhetoric from both political parties regarding the next and latest debt limit crisis. Republicans argue that the key is to cut spending and reduce the debt limit, but they have failed to do that for forty years. In fact, before President Biden, Republican administrations boasted some of the largest increases in the debt limit.

On the Democrat side, we will hear terrific sob stories regarding how failure to raise or suspend the debt ceiling will bring the most pain to America’s poor. Never mind the billions of dollars wasted in government excess in even the most recent spending bills passed by the Democrats.

On the Democrat side, we will hear terrific sob stories regarding how failure to raise or suspend the debt ceiling will bring the most pain to America’s poor. Never mind the billions of dollars wasted in government excess in even the most recent spending bills passed by the Democrats.

We would do well to ignore both sides of this debate. The debt ceiling crisis is not a Republican or Democratic issue. It is the latest evidence of a broken system where “kick the can down the road politics” has dominated over fundamental issues like spending and debt while we are distracted by our elected officials with nonsense.

Even while economists and politicians assure us there is no way the US will default, there is less and less reason to believe such guarantees. We live in an age where unprecedented is the leading definer of our times. Change occurs when leaders make difficult and unpopular decisions. Our leadership appears to lack such conviction and fortitude. Perhaps we, the electors, do as well, as we keep passing the helm of leadership to those who inspire our emotional shock and outrage instead of those with proven competence and character.

The looming crisis should surprise no one when it finally hits.

2 Comments on “The Recurring Debt Limit Crisis – Kicking the Can Down the Road”

Comments are closed.