This article on the 2022 Economic Crisis was broken into two parts because we all know the other guys can’t handle reading more than the headlines and a short bit of the article. If you have not read Part 1, read here first.

The Government Is Here to Help; Please Send Us Your Mandated Donations

When you purchase an investment or any financial services product today, you may be surprised by the stack of paperwork involved in the transaction. Most of us don’t read the mountain of tiny print lawyer-speak because not only do we not understand it, but we don’t have the time. A few of us may have lawyers who do the reading for us, but for most, we unconsciously depend upon the institutions themselves to back up the safety and security of the investment. That’s a bad idea.

Most of that paperwork is the result of the government’s response to prior economic meltdowns and scandals. When the government puts in new safety measures to protect consumers and society, we get more paperwork. Little else happens. That is why we keep repeating this cycle, and that is part of the problem.

In 2008, despite people’s life savings of wiped out in the economic meltdown where the causes could be linked directly to fraud and irresponsibility in the finance industry – no one went to prison. In fact, companies that played leading roles in the meltdown received government bailouts in the name of “too big to fail.” That means taxpayers rewarded their behavior even as those taxpayers lost their jobs and savings. It wasn’t just companies that got bailouts. Those companies’ leaders and CEOs frequently received golden parachutes, financial severance packages valued in the millions.

Countrywide, one of the infamous companies during the 2008 meltdown, saw a $700 million loss and laid off more than 11,000 employees in a five month period. Even as that occurred, Countrywide’s CEO received an estimated $23.8 million retirement package as he departed the company in shame. That is only one of many similar and often worse examples. It remains unclear why we cast Bernie Madoff as a villain, but the heads of many companies like Countrywide, Merrill Lynch, Citigroup, and others raked in millions of dollars in future years after the meltdown.

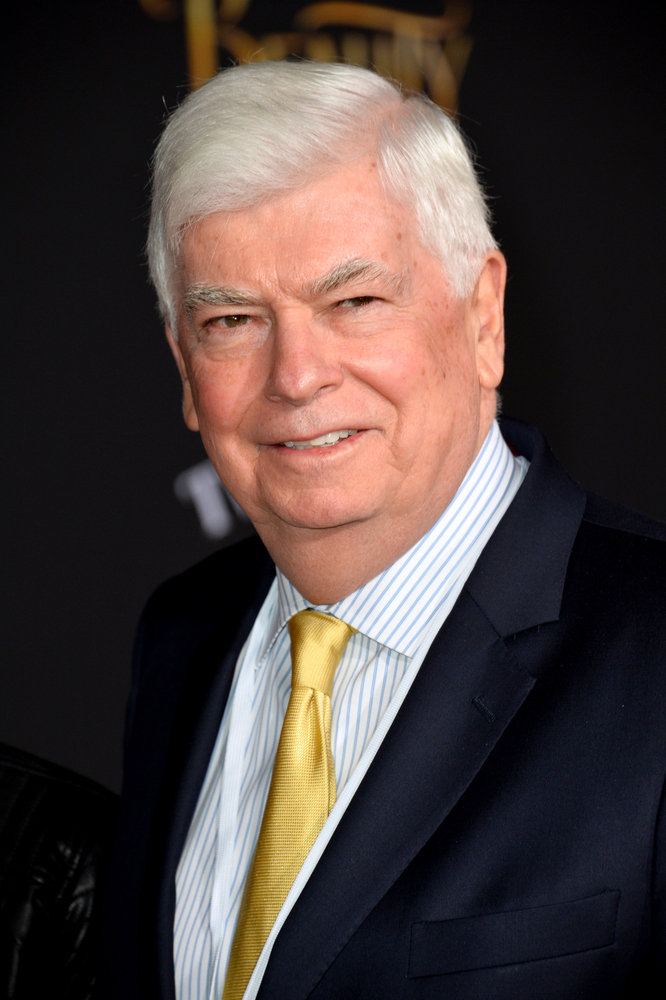

Senator Chris Dodd co-sponsored the Dodd-Frank Wall Street Reform and Consumer Protection Act in response to the meltdown. While President Obama’s administration called it the greatest change to financial supervision since the 1930s, Dodd retired from politics and went to work as a lobbyist. Before and after his retirement, Dodd faced numerous allegations and scandals regarding conflicts of interest. Those scandals included allegations that he received donations from the same organizations he supported bailing out in 2008. This was one of the authors of America’s solution to the financial crisis!

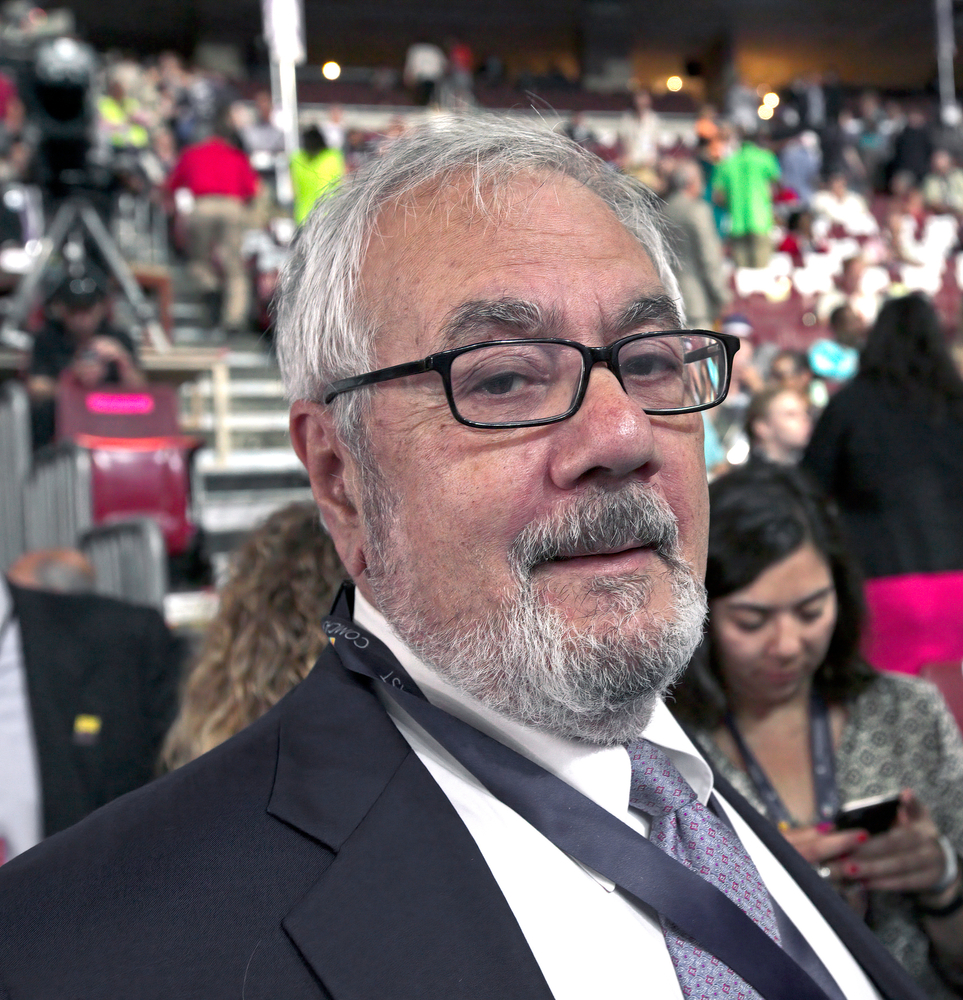

The other sponsor of the Dodd-Frank Act, Barney Frank, retired from Congress and went to sit on the board of a prominent bank in New England. Dodd and Frank both serve as excellent icons revealing the American political system’s conflict of interest regarding excess and scandal in the finance industry. Washington DC cannot fix the problem because, more often than not, it is part of the problem.

The Great Chasm

America has a significant problem of economic inequality. I detailed this in a podcast series years ago, The History of Economic Inequality. We do not deal with the issue because it is too easy to excuse it during the boom years. The prices of our homes are increasing. Our 401ks are growing. We receive a cost of living increase every year. But when the economic crisis hits, we suddenly realize how big the divide is between the rich and poor in this country.

According to the Pew Research Center:

- In 2018, households in the top fifth of earners (with incomes of $130,001 or more that year) brought in 52% of all US income, more than the lower four-fifths combined.

- The wealth gap between America’s richest and poorer families more than doubledfrom 1989 to 2016,

- In 1989, the richest 5%of families had 114 times as much wealth as families in the second quintile (one tier above the lowest), at the median $2.3 million compared with $20,300. By 2016, the top 5% held 248 times as much wealth at the median.

- In 1989, the richest 5%of families had 114 times as much wealth as families in the second quintile (one tier above the lowest), at the median $2.3 million compared with $20,300. By 2016, the top 5% held 248 times as much wealth at the median. (The median wealth of the poorest 20% is either zero or negative in most years we examined.)

- The richest families are also the only ones whose wealth increased in the years after the start of the Great Recession. From 2007 to 2016, the median net worth of the top 20% increased 13%, to $1.2 million. For the top 5%, it increased by 4%, to $4.8 million. In contrast, the median net worth of families in lower tiers of wealth decreased by at least 20%. Families in the second-lowest fifth experienced a 39% loss (from $32,100 in 2007 to $19,500 in 2016).

- Middle-class incomes have grown at a slower rate than upper-tier incomes over the past five decades.

Earlier this month, an Andy Warhol painting of Marilyn Monroe sold for a record $195 million. At the same time, Americans are paying nearly 10% more for groceries than they were a year ago. The reality of an economic crisis means the average Americans see their incomes decrease and their savings disappear even while the price of gas and groceries rises. There is something incredibly perverse when billionaires see their wealth and excess grow at the same time that poor people cannot afford to eat or get to work.

In the context of that perversity, political extremism and populism breed. The Tea Party Movement came out of the frustration of the 2008 meltdown. The Occupy Movement and the Black Lives Matter movements (it was about far more than racism) arose as counter responses to the Tea Party and the effects of the meltdown.

It is worth asking, is our society in the position to handle another wave of political populism and extremism? The January 6 insurrection and anti-lockdown protests of the last two years show the boiling resentment on the right side of the political spectrum. Although it is framed differently in the popular media, the left has the same frustration and risky extremists from Portland to Minnesota.

A reminder, this is not a left or right political issue. Perhaps the greatest pity should be reserved for those who continue to explain and contend with this crisis on partisan political grounds. They do not realize both sides are using them. To put it another way, neither Joe Biden nor Donald Trump cares about you.

We have a systemic issue of corruption and corrosion on our hands, and I do not believe our society can withstand the body blows this economic crisis is about to deal it.

What To Do?

What can be done? That is the really bad news.

A decade of unprecedented low-interest rates convinced us that government excess was normal and neutralized the financial instruments the Federal Reserve and Washington DC could use to combat the unfolding crisis. The supply chain crisis shows how impotent our leaders and tools are to combat its effects. This week the President of the United States utilized the Defense Production Act not to battle Nazis and world war (the original design of the DPA) but to find a means of getting formula to infants.

We do not have the leadership, the civic tolerance, or the strength to overcome the 2022 economic crisis. It is here and it is about to get really bad.