This is part one of two articles discussing the next economic meltdown. You can find part 2 here.

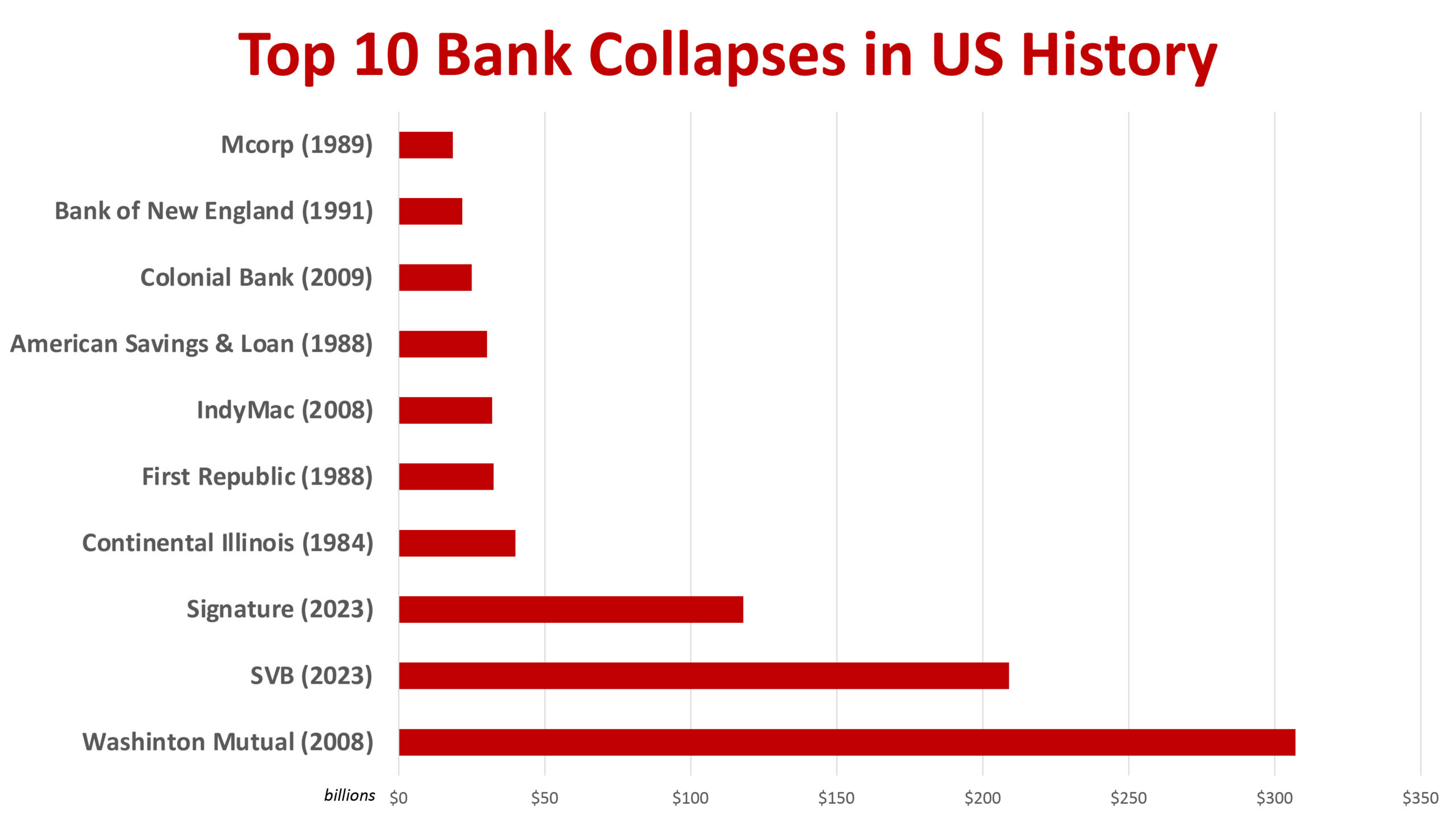

At the end of last week, Silicon Valley Bank (SVB) became the second-largest bank failure in US history, with more than $200 billion in assets. Janet Yellen, Secretary of the Treasury, said on Sunday there would be no bailout this time, in other words, no repeat of the 2008 meltdown when the government rescued the worst and wiliest from the consequences of their excess with American tax dollars. That same day, Signature Bankbecame the third-largest bank failure in US history. The US government swooped in to stop the panicked run on the Signature, but many are worried this is the beginning of a new financial crisis reminiscent of 2008.

The demise of SVB and Signature each had their own unique causes. SVB was rooted to venture capital in the tech industry, which has been hammered in the economic downturn of the last two years. Signature was heavily vested in cryptocurrency, a mirage of riches whose base reality and lack of substance has been exposed in recent months. But they each also represent the fundamental flaws of our dysfunctional economy.

In nearly every economic crisis in modern history, a sign of the times (usually seen in retrospect) occurs when fringe behavior becomes mainstream. The fact that these banks were not involved in mainstream transactions does not mean they get a pass and we can rest assured that the economy is alright. The sheer size of the bank collapses this past week shows what may have started as activity and behavior on the margins has moved to the center of our national economy and financial system. That was what happened in 2008. It is what is happening again today. Imprudent and irresponsible behavior, driven by greed, resulted in a crisis. Shocking!

-

Also Read: This Is What Happens In An Economic Crisis

The next economic meltdown may not have begun with the collapse of SVB, but it is undoubtedly coming. Don’t be duped into believing that an economy built on unprecedented levels of debt can avoid a reckoning with the consequences and harsh realities of basic economic principles. The economic realities many of us accept as normal are, in fact, built upon illusions, and the harsh onset of reality is dead ahead.

A Society Built On Crazy Excessive Debt

According to the New York Federal Reserve, at the end of 2022, US consumer debt set a new record even as delinquencies began to surge across the country. Debt across all categories reached $16.9 trillion, $1.3 trillion higher than the year before. For the sake of scale, the total US GDP is around $23 trillion. The rise in US consumer debt between the end of 2021 and 2022 was nearly equal to the rise in US GDP between 2000 and 2020. See the problem?

The number of US mortgages in delinquency for more than 90 days has nearly doubled from where they were a year ago. That is troubling news, but fear that the next financial meltdown will come from the mortgage is so 2008. Auto loan delinquencies have more than tripled. Two out of thirteen Americans owe car payments over $1,000 a month. Inflation is not as significant a mystery as our talking heads in the government and academia try to make us believe. When money comes easily, we spend more, and when we spend more, prices go up. The price of a new vehicle has risen 20% since the start of the pandemic, and 37% for used vehicles. These prices will continue to rise as the debt remains easily accessible. And those rising prices are not restrained to the car industry. These distortions of excess debt spread throughout the economy.

Credit card debt is up nearly 18.5% compared to a year ago, setting a record $930 billion in the final quarter of 2022. Americans opened more than 202 million credit accounts in those three months alone. Young people ages 18-25 accounted for the largest number opening these new accounts.

-

If you are benefitting from this article you might also enjoy our History Of Economic Inequality podcast series. This series tells the modern history of the American economy from a non-partisan perspective.

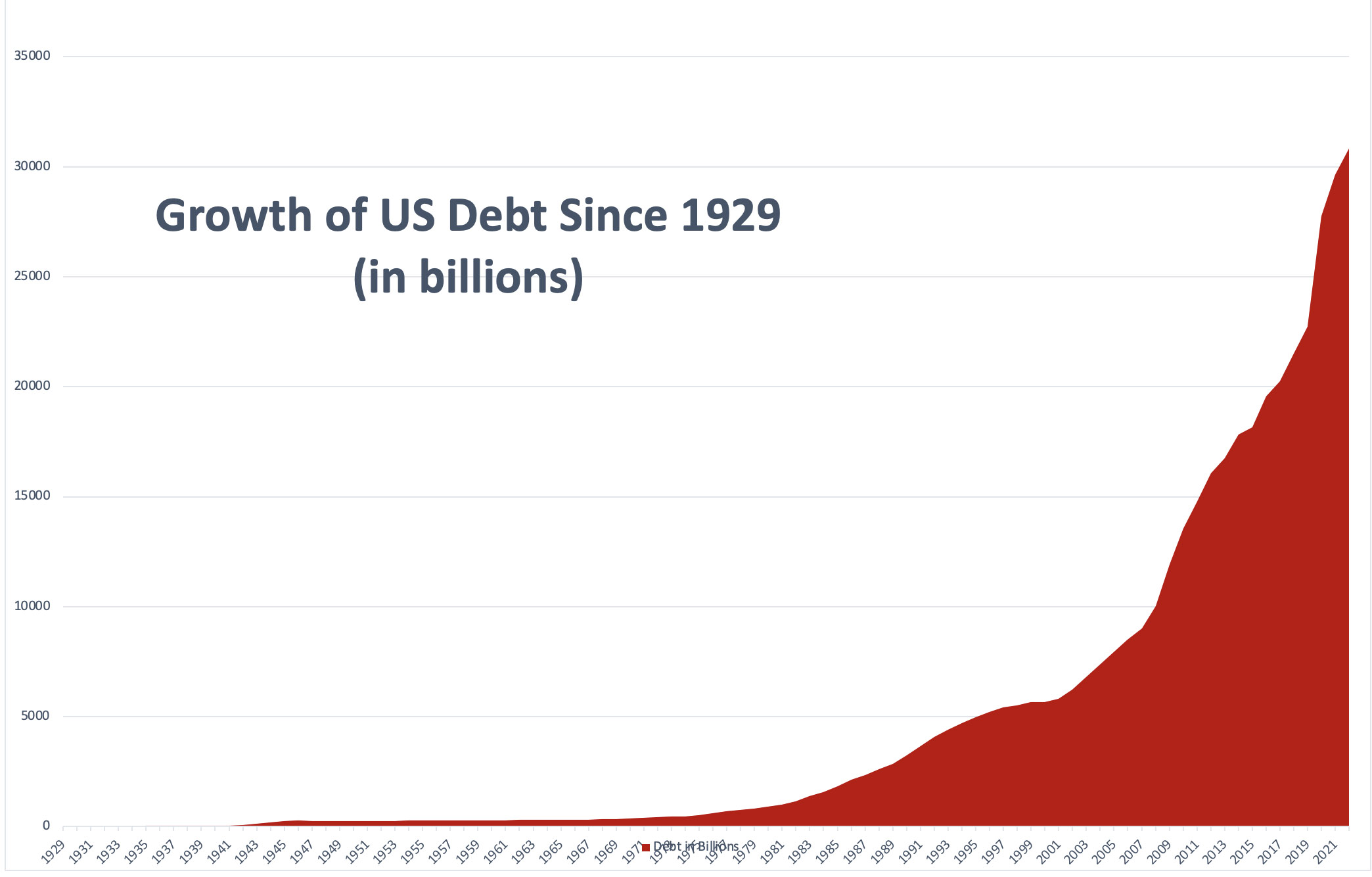

This is not merely a reflection of irresponsible Americans. It is a reflection of the new American way of life. Our own government’s financial credibility is teetering on the edge. As US consumer debt has exploded, so has government debt.

At the end of 2022, US government debt was at $29.6 trillion. By mid-February, it was at $31.5 trillion. That number will grow once Congress and the President compromise on where to spend these dollars the government doesn’t have; until then, we have the debt ceiling crisis hanging over us.

When counted together, total public and private debt in the US economy is now at 350% of GDP. The idea that this debt will ever be paid off or even significantly reduced is contrary to the active platforms of either leading political party and antithetical to the American way of life. A series of studies and papers presented by leading think tanks and government organizations suggest that debt-to-GDP ratios over 90% lead to worse growth in the economy. That is the unavoidable operating reality the covid era shocked us into.

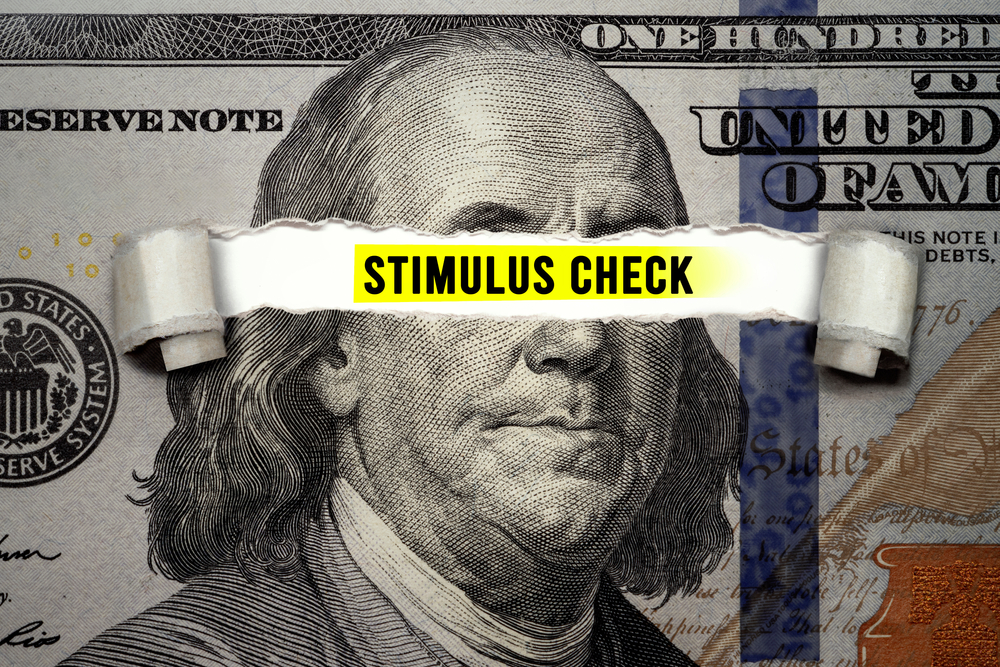

In a crazy era of pandemics and lockdowns, many Americans experienced freezes in their debt payment requirements along with government stimulus benefits. Following three years of various measures to ease the burden of payments from debts to house rentals, not to mention stimulus packages under both Presidents Trump and Biden, the average American’s fiscal status got worse instead of better.

Since the end of the pandemic aid, the country has experienced a surge in bankruptcies. In January, bankruptcy filings shot up 19% compared to the year before. Fitch Ratings warned last month that institutional loan defaults are rising, primarily driven by the tech sector, but the consumer sector is also doing its part. February saw $4.1 billion in institutional loan defaults.

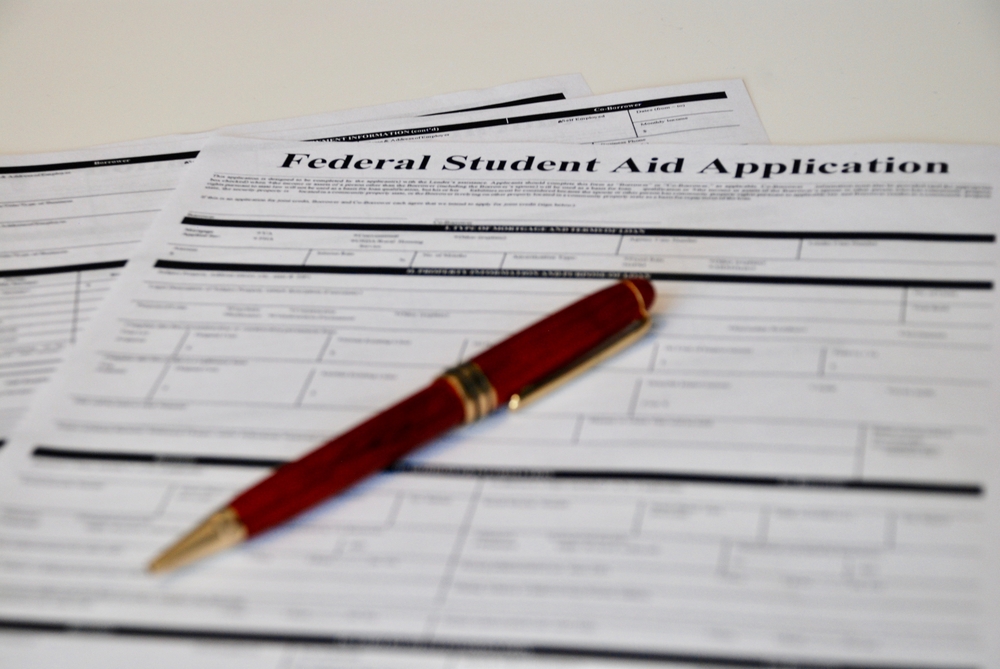

And all of that is happening while our student loan payments are on hold. For three years, most Americans have taken advantage of the freeze on student loan payments initiated through the pandemic emergency, but that relief is about to end. Student loan debt has consistently outpaced personal income growth for years, and the current volume of student loan debt is at $1.76 trillion – more than double what it was in 2010. (Note: to understand why student loan balances surged in the last decade, see the lesson on inflation above. When the money is easy, the prices rise – even if the quality of the purchased product does not.)

[…] This is part two of this article discussing the coming economic meltdown. You can find part 1 here. […]

[…] Bank Failures, Government Interventions, and a Dysfunctional Economic System Beginning to Implode […]

Comments are closed.