Readers who give even the most minimal levels of attention to financial news and headlines recognize the name Evergrande from the last week’s headlines. (Not to be confused with Ever Given, the massive boat that blocked the Suez Canal earlier in 2021.) Global markets tumbled on fears of an Evergrande default last Monday and rippled throughout the week. The drama of Evergrande demonstrates the topsy turvy world we now live in where up is down, down is up; Republicans spend excessively, Democrats push for law and order, Communists promote responsible capitalism, and democracies promote government-subsidized lifestyles of consumption. Evergrande is also a mere prelude of what is to come.

What Is Evergrande?

Historically we can imagine Evergrande as a mere footnote of the pending drama of bursting economic and debt bubbles worldwide. It is chapter two of the books that will be written five years from now that explain how everything came undone in the global debt overreach. Those authors of tomorrow will explain how Evergrande seemed like big news at the time, but it was nothing compared to what followed. How did we not see what was coming?

Evergrande is (was) one of China’s largest real estate developers. The company’s business model relied on rapid and debt-fueled expansion to dominate the Chinese housing market for years. Evergrande high-rise apartments dot modern Chinese city landscapes. While the company’s founder was briefly China’s wealthiest businessman, Evergrande diversified into various fields, including amusement park construction, film and entertainment, life insurance, baby foods, and even electric vehicles. In April, Evergrande’s electric car unit share price was higher than Ford Motor Company’s. Last week it dipped to $0.21 a share.

As Chinese housing demand shrank in the last year, Evergrande’s house of cards began to tumble. In the last few weeks, many employees stopped receiving paychecks. A swift collapse of the company’s mountain of corporate debt has already started.

Last week Evergrande missed an $83 million bond payment placing the company at risk of default. Technically they have a 30-day grace period to get the payment in on time. Still, if they cannot make their interest payments now, it is unlikely investor confidence will prop the company up long enough to make the payment at the end of October. Finance reporters began comparing the Evergrande collapse to the 2008 Lehman Brothers that triggered the global economic meltdown.

Interestingly China’s Communist leadership appears set to let Evergrande fall. No corporate welfare for this economic behemoth as China’s government has so far refused to acknowledge Evergrande as too big to fail. The failure of Evergrande could play into Xi Jinping’s political priorities. In June, the leader of China cited tackling financial risks, poverty, and reducing air pollution as the big three “tough battles” the country needed to wage. China places a premium on social stability but appears ready to let the Evergrande collapse come what may to limit further irresponsible behavior among rising corporations.

The US Pilots a Different Path

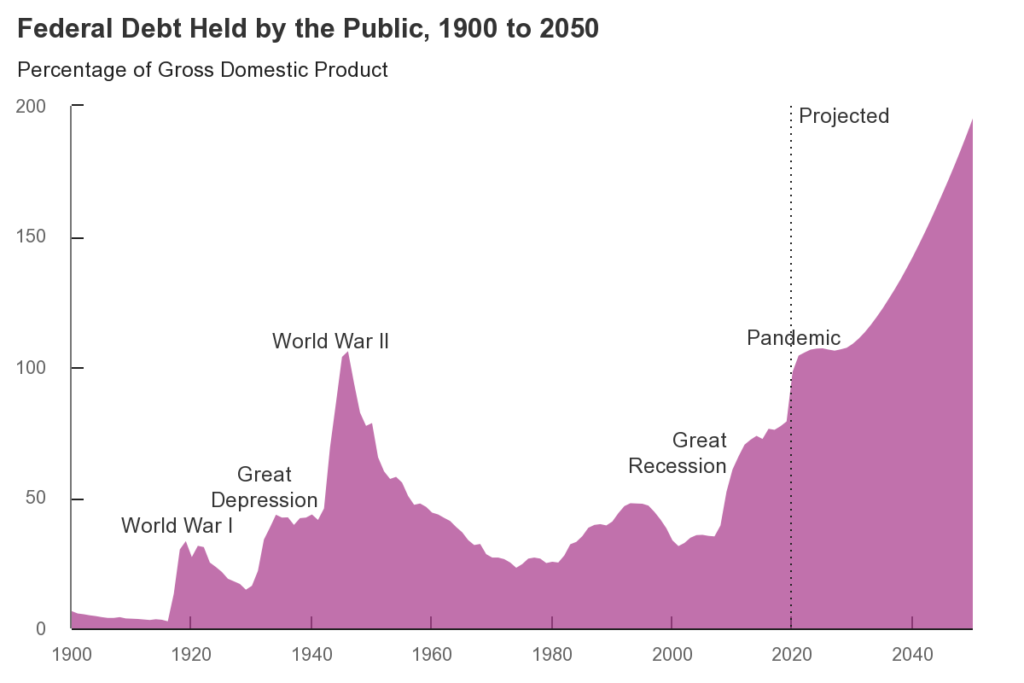

As China enforces corporate responsibility, the former leader of free world capitalism, the United States, is navigating a different route. After the economic meltdown of 2008, few if any structural adjustments to the US economy were implemented. Instead, the US government dumped money into corporate welfare programs to rescue one corporation after another. Interest rates were held to unprecedented lows. A decade of easy money fueled an economic boom through the Obama years and into the Trump years. Corporations got fatter. All forms of debt skyrocketed. The US government stepped into larger and larger roles of subsidizing the corporate and private lifestyles of Americans. While capitalists celebrated a booming economy, few acknowledged the US government’s role in propping up that boom.

This week Congress is once again locked in a debate to raise the debt ceiling. This is an irresponsible move that amounts to increasing your credit card spending limit after maxing out the credit card. Republicans have blocked the move, putting on a misplaced dusty hat of fiscal responsibility they lost during the years of the Trump administration. While the Democrats are unashamedly and irresponsibly in favor of raising the debt ceiling, Republicans are unashamedly hypocritical in their opposition to the move. Congress has raised the debt limit 78 times since 1960, 49 times under Republican Presidents, and 29 times under Democrats.

Monopoly Money

The public is not outraged by these levels of excess and irresponsibility because no one believes money is real anymore. Even while debates over the debt limit raged this week, the House of Representatives pushed through a $3.5 trillion budget that includes $200 billion for universal pre-school for children ages 3 and 4, a $1,400 increase in Pell Grant Awards for low-income students, $3,600 child tax credits, and dental, hearing, and vision benefits for Americans on Medicare. Of course, the new budget bill also aims at social justice and equity issues, not to mention carbon reduction.

All these new additions to federal overreach would be nice, but you don’t buy a new speedboat when your credit card is maxed out. Rather than directing the national economy toward greater fiscal responsibility, the Biden administration and Congress are pumping up the volume in excess spending and federal takeover of individual and corporate responsibility. Just like the many administrations did before.

A New Day In America

The gap between personal responsibility and government spending has grown so wide that the concept of consequences does not seem to register in people’s minds any longer. Our culture has been trained to think in terms of what the government will give them next. Where is my stimulus check? It’s not about the crisis or what is needed but what I am entitled to. These absurd policies and economic decisions do not occur without consequences, and the collapse of social norms that encourage personal responsibility is only the tip of the iceberg.

While China opts to let its citizens digest the bitter fruit of Evergrande’s excess, the US government has convinced us we are entitled to free childcare.

The behavior of the US is the behavior of people operating in a financial bubble. Our financial status is obviously artificial, but we keep enjoying the benefits and turn a blind eye to the absurdity all around us.

- US companies now face the highest corporate debt in American history at $10.5 trillion. This monster was fed with the historically low-interest rates since 2008.

- Forty-four million Americans hold a piece of the $1.6 trillion student loan debt pie. These numbers surged after 2008 as more Americans went back to school and lived off these student loans. The price of school also increased. Before a suspension in student loan payments during the pandemic, defaults were surging. Once the student loan payments resume in January 2022, these defaults are expected to skyrocket again.

- US household debt broke new records in the second quarter of 2021, increasing by $313 billion. At the end of June, Americans held $14.96 trillion in debt.

- While most Americans received stimulus checks in their bank accounts during the pandemic, a housing boom was born. American mortgage debt in the second quarter of 2021 rose to $10.44 trillion. Forty-four percent of these purchases originated in the last year (new home purchases and refinancing).

Evergrande is a peek of what is coming, and when this tsunami of economic collapses begins, the torrent will be unstoppable. We cannot lower the interest rates any further. We cannot continue to pour dollars into the trading system.

The only thing holding the system together right now is a collective wink and nod to go along with these illusions of fiscal strength. That fragile credibility will not last long much longer, and when it finally crumbles – oh, the horror!